Child Tax Credit 2024 Phase Out Income – With the 2024 tax season starting tomorrow, you might be looking for any tax credits you’re eligible for. While you probably already know whether you’re eligible for the federal child tax credit of up . Here’s how much the child tax credit is for 2024, and why you might want to wait to file your tax return this year. .

Child Tax Credit 2024 Phase Out Income

Source : itep.org

Here Are the 2024 Amounts for Three Family Tax Credits CPA

Source : www.cpapracticeadvisor.com

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

The American Families Plan: Too many tax credits for children

Source : www.brookings.edu

Policy Basics: The Earned Income Tax Credit | Center on Budget and

Source : www.cbpp.org

Child Tax Credit Definition | TaxEDU | Tax Foundation

Source : taxfoundation.org

Build Your Own Child Tax Credit 2.0 | Committee for a Responsible

Source : www.crfb.org

Child Tax Credit Definition | TaxEDU | Tax Foundation

Source : taxfoundation.org

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

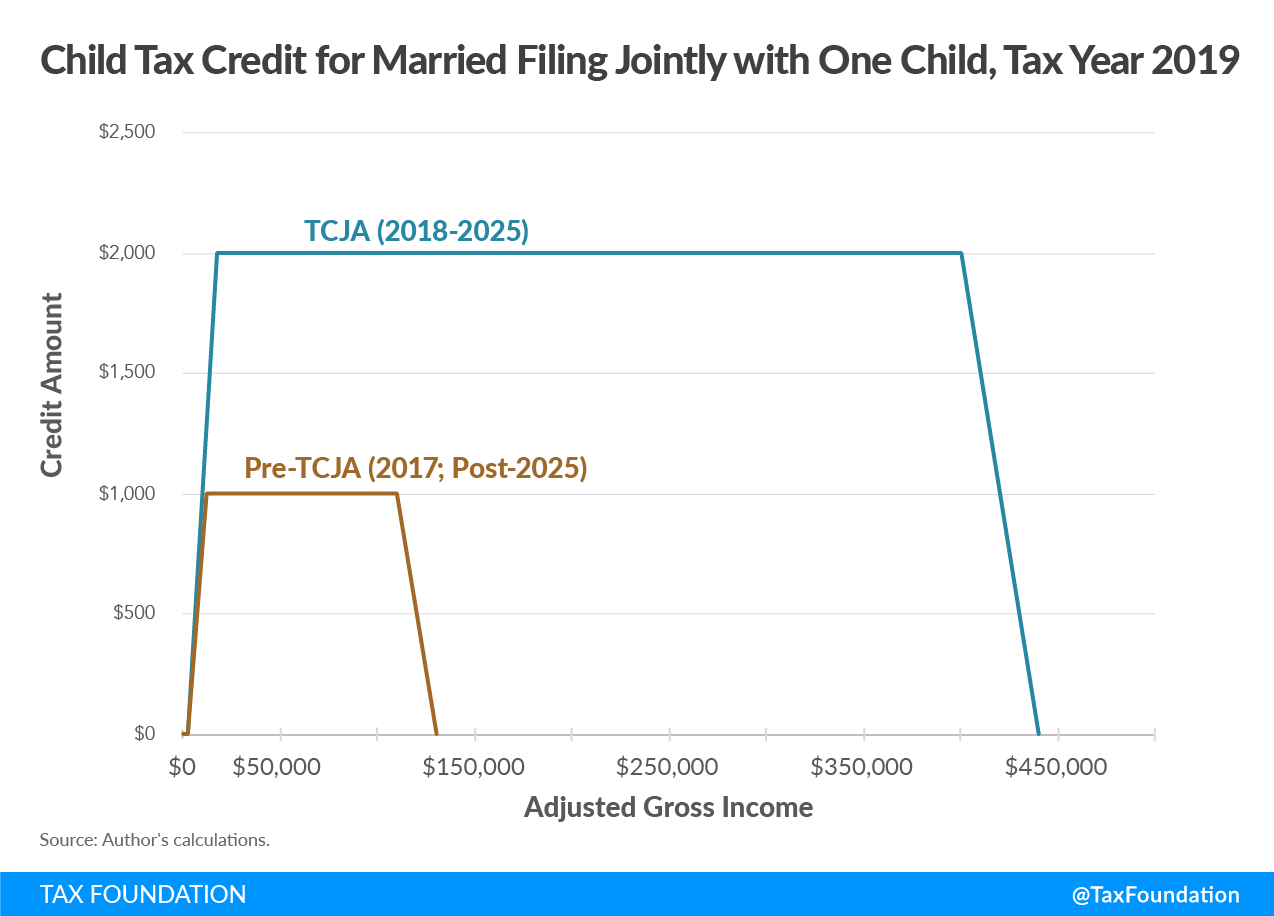

Child Tax Credit 2024 Phase Out Income States are Boosting Economic Security with Child Tax Credits in : This year, the what-if involves the possible expansion of the child tax credit, which likely would be retroactive to 2023. We are not talking about a return to sending out monthly and elect in . Income thresholds also come into play, causing the credit to phase out for higher earners is slated to increase to $1,800 for 2023, $1,900 for 2024, and $2,000 for 2025. The overall child tax .